does california have an estate tax in 2021

Effective January 1 2005 the state death tax credit has been eliminated. Estates generally have the following basic elements.

The State Of The Inheritance Tax In New Jersey The Cpa Journal

Does California Impose an Inheritance Tax.

. When a person passes away their estate may be taxed. As of 2021 12 states plus the District of Columbia impose an estate tax. In 2021 this amount was 15000 and in 2022 this amount is 16000.

There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Alternative Minimum Tax California Perfect Tax.

074 of home value. An estate is all the property a person owns money car house etc. Tax amount varies by county.

The Gift Tax Exemption Threshold Is 15000 In 2021. The cumulative lifetime exemption increased to 11700000 in 2021 until. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

California does not have an estate tax. You have not used the exclusion in the last 2 years. Each California resident may gift a certain amount of property in a given tax year tax-free.

Again as noted it is still important to put in place an estate plan so that your estate avoids probate. People often use the terms. You do not have to report the sale of your home if all of the following apply.

Estates valued at less. The median property tax in California is 283900 per year for a home worth the median value of 38420000. In fact few states do as of 2021 only 12 states and the District of Columbia impose an estate tax.

The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your. The Golden State also has a sales tax of 725. The tax-free annual exclusion amount increased to 15000 in 2018 and remains the same in 2021.

If you live in California and you are presently subject only to the Federal estate tax you might be thinking it wont affect you if your estate isnt worth 1206 million for an individual or 2412. Those states are Connecticut Hawaii Illinois Maine. Home does california have an estate tax in 2021.

However California is not among them. Does california have an estate tax in 2021. Your gain from the sale was less than 250000.

California does not have an inheritance tax or a death tax in 2021.

2022 State Business Tax Climate Index Tax Foundation

Everything About California Capital Gains Tax

What Is Estate Planning And Do I Need An Estate Plan In California

California Estate Planning Tax Cunninghamlegal

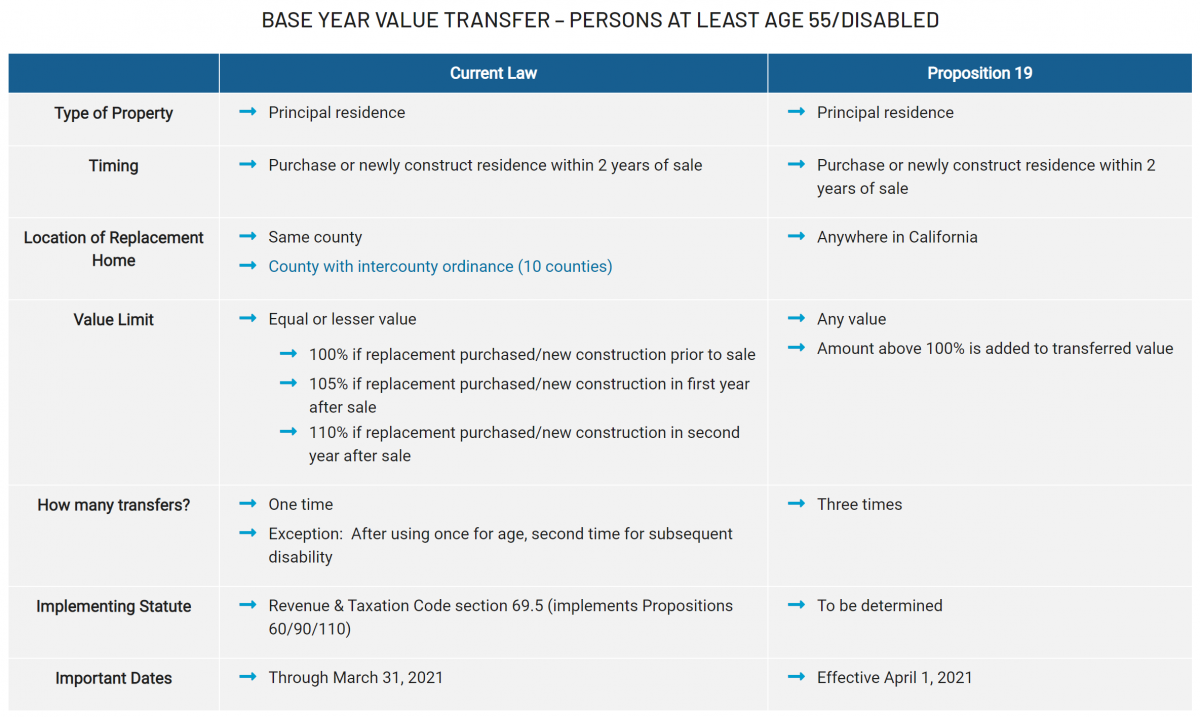

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

Federal Estate Tax Changes By The End Of 2021 Aronoff Rosen Hunt

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

Ca Prop 19 Passes And Opportunities Prior To Biden Tax Laws

What S The Estate Tax In California Feldman Legal Blog

Will Your Inheritance Get Hit With The California Estate Tax Financial Planner Los Angeles

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Property Tax Reassessment Strategy In California After Proposition 19

California Income Tax Returns Can Be E Filed Now Start Free

Estate Tax In The United States Wikipedia